Wawa and Costco are consumers’ favorite places to fill up their gas tanks, according to a study by Market Force Information. Nearly 7,000 consumers were polled for the study, which was designed to uncover where consumers prefer to fuel up and why they prefer one chain to another, as well as trends in mobile app usage.

The study revealed that, while the majority of motorists still fuel up at traditional gas stations and convenience stores, grocers and wholesale clubs continue to gain ground. For their most recent trip to the pump, 69 percent said they visited a gas station or convenience store, while 31 percent chose a grocery, wholesale club or big-box chain.

Because the critical drivers for customer satisfaction vary between gas stations and grocery or big-box stores, Market Force evaluated each category separately.

Because the critical drivers for customer satisfaction vary between gas stations and grocery or big-box stores, Market Force evaluated each category separately.

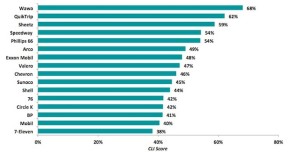

For the rankings, Market Force asked participants to rate their satisfaction with their most recent gas station or convenience store experience, and their likelihood to refer that store brand to others. The results were averaged to attain a “Composite Loyalty Score.”

Wawa ranked highest with 68 percent, edging out QuikTrip, which took the top spot in the 2014 study. QuikTrip was second with a score of 62 percent and Sheetz was third with 59 percent. All of the top three are corporate-owned, regional brands. Speedway and Phillips 66 tied for fourth, with Phillips 66 emerging as the highest-ranking national brand.

QuikTrip delivers on service, Sheetz wins on loyalty

Market Force also evaluated how gas station and convenience store brands are delivering on a spectrum of attributes that impact customer satisfaction, such as service and appearance.

Chevron ranked highest for fuel quality and Arco was voted the fuel price-leader. Wawa, which offers made-to-order hoagies, breakfast sandwiches and other food options, took the top spot in the fresh food category. QuikTrip came in first for customer service and appearance for a second consecutive year. Sheetz’s loyalty program was a clear favorite, and it also tied with Wawa for quality coffee.

“We found that one in seven consumers was dissatisfied with their most recent experience at the pumps,” said Cheryl Flink, chief strategy officer for Market Force Information. “With the plethora of options available to drivers, gas stations and convenience stores must both execute flawlessly on the basics like bright, appealing imaging and deliver in experience-related areas such as customer service and specialty foods.”

Costco No. 1 among wholesale, grocery and big-box retailers

Consumers seem to largely prefer wholesale clubs vs. grocery stores and big-box retailers for gas, likely for their deeply discounted prices. When Market Force ranked the top wholesale clubs, grocers and big-box chains on the customer loyalty index, three wholesale clubs led the pack—Costco ranked first, BJ’s Wholesale Club was second and Sam’s Club was third. Kroger and Walmart rounded out the top five.

Costco and BJ’s emerge as satisfaction attributes leaders

When Market Force examined how grocery stores, wholesale clubs and big-box retailers were performing on a spectrum of attributes that impact customer satisfaction, Costco took the top spot in five of the nine categories, including fuel quality, fuel price, customer service, appearance and brand reputation.

BJ’s also performed well, leading on ease of entry and exit and good coffee, and tying with Costco for fresh food. Kroger ranked first for its loyalty program by a large margin, besting Costco by nearly 40 percent.

Motorists using mobile apps to find cheap gas

Fueling-related mobile apps are picking up steam among motorists, particularly those on the hunt for low-priced gas. Ten percent of study participants said they have used a gas app. Generation X reported the highest usage rates, although there was little differentiation across age groups. When asked which features they have used within a gas app, gas price comparison came out on top at 78 percent, followed by finding a gas station and reporting gas prices.

GasBuddy, which uses crowdsourcing to check for the cheapest gas prices in an area, is far and away the most popular app, with 69 percent indicating they have used it.

The survey was conducted in June 2015 in the U.S. The pool of 6,935 respondents reflected a broad spectrum of income levels, with nearly 52 percent reporting household incomes of more than $50,000 a year. Respondents’ ages ranged from 18 to more than 65. Approximately 64 percent were women and 36 percent were men.