Last updated on June 21st, 2018 at 04:11 pm

by Michael J. Haaf

Last fall, I was asked to join the board of a promising startup. Although I had never heard of the company, I was immediately impressed by the tech firm’s focus on helping grocery chains fight back against Amazon-Whole Foods, Walmart and other retailers entering the traditional grocery space with a wide assortment of digital solutions and offers.

As a grocer with more than 15 years in the business—first as SVP of sales, marketing and business strategy for Food Lion and then as EVP and GM at Lucky Supermarkets—I have been following the digital transformation of this industry for a while. So I jumped at the chance to join the board of a white-label e-commerce provider with some awesome clients both in the U.S. and in Israel, where the company was founded.

As I got to know the Self Point team and the industry better, I was astounded by all the different players in the space, their vastly different business models and, especially, their enormous differences in costs to the grocer. I decided that irrespective of my position with Self Point, there were probably many grocery executives out there struggling with similar questions. These include how do I know which partner is right for my business? How do I understand a landscape that runs the gamut from completely outsourced, turnkey solutions to seven-figure custom implementations?

As I got to know the Self Point team and the industry better, I was astounded by all the different players in the space, their vastly different business models and, especially, their enormous differences in costs to the grocer. I decided that irrespective of my position with Self Point, there were probably many grocery executives out there struggling with similar questions. These include how do I know which partner is right for my business? How do I understand a landscape that runs the gamut from completely outsourced, turnkey solutions to seven-figure custom implementations?

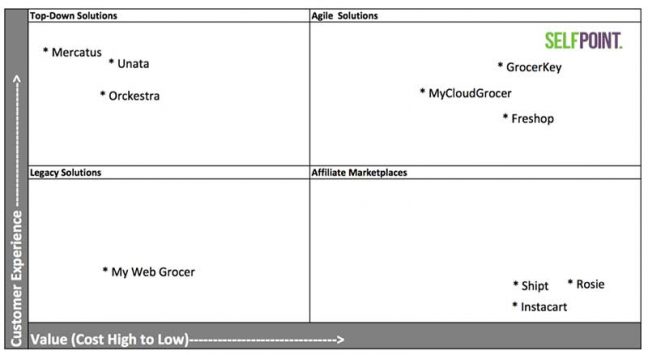

So I embarked on some research, trying to understand all the different options, and in particular where did Self Point fit into the landscape? I hoped that my research would culminate in a Gartner-style white paper, complete with a “magic quadrant” that could not only highlight Self Point’s place in the industry but be a solid resource to grocers.

As I was doing my research, I found my perspective as a grocer benefiting Self Point’s business strategy and product road map. Self Point, like many startups, is composed mainly of technology veterans. I suddenly found myself in pitch meetings representing the company on multiple sides of the continent, talking about the operational implications of platform implementation and calculating the ROI of Self Point’s unique offering on white boards with several different prospects. By the time my fellow board members asked me to step into the role of CEO, I had concluded that Self Point does indeed occupy a magic quadrant in the market. They are an agile solution that offers a fantastic customer experience at a great value; who wouldn’t sign up for that combination?

So it is from the clearly biased view as incoming CEO, and industry veteran, that I offer guidance to grocery executives as they contemplate this very complex market. The purpose of this guide is to provide insights and resources to assist grocers in making decisions about the right partners to maximize your mobile and online storefronts.

Complete with a comparison chart and checklist of questions to ask, you will get the information you need to move forward with your e-commerce strategy. A solid e-commerce platform will elevate customer experience and loyalty and enhance both your top and bottom lines. Since there are many different players to evaluate, let’s start with the big picture.

Grocers v. omnichannel brands and gadgets

Amazon’s acquisition of Whole Foods, combined with Walmart’s rapid growth in this space, has changed the landscape dramatically in a very short period of time. The Food Marketing Institute (FMI) now predicts that 70 percent of consumers will be buying groceries online by 2024 and that the online grocery business will be $100 billion by 2022 (“FMI and Nielsen: 70% of Consumers Will Be Grocery Shopping Online by 2024” and “By 2022 consumers could be spending $100 Billion.”)

There seems to be yet another new competitor, new offering or new twist to online grocery with each day’s headlines. Offering the convenience of home delivery or click-and-collect are no longer nice-to-haves. They are key components of frictionless shopping and critical in every grocer’s journey of digital transformation.

Unfortunately, competition is coming not just from Amazon and Walmart but also from other retailers, omnichannel brands and technology companies determined to make consumers’ lives easier. Voice-assisted virtual assistants like Amazon Echo, Google Home and Apple HomePod are creating shopping lists and ordering products in mere seconds. Meanwhile, smart appliances are also bypassing grocery store visits by automatically ordering everyday essentials like coffee pods, laundry detergent and even toilet paper. Companies of many different shapes and sizes are all trying to take market share away from traditional grocers. Ultimately, consumers want what they have always wanted: easy access to quality food at a fair price.

To compete, mobile and online shopping must be a top priority for grocers. The key is to offer the convenience of digital commerce without losing the “personal touch” of being the neighborhood grocer. This can be done with measured emphasis on the customer experience throughout the consumer’s online buying journey. It can be as simple as making sure your digital experiences bring the look and feel of the physical store to life online. Or, it can be as complex as ensuring every home shopper knows the name of the picker collecting their orders, as well as communicating in real-time about order modifications and substitutions.

Balancing cost with customer experience

Before grocers can choose a partner for their digital initiatives, they must understand how the various players who serve this sector differ and how they have adapted their offerings to the marketplace. When making the decision on an ideal digital commerce partner, grocers must consider two key vectors: value and customer experience.

This chart illustrates 10 of the top e-commerce solutions for consideration, and below are insights to assist in choosing the best partner for your business.

Agile Solutions: Self Point, Freshop, My Cloud Grocer and GrocerKey

These solutions offer technology at price points that businesses, large and small, can afford. They also have feature sets that are quite similar to the big budget top-down solutions at a fraction of the costs. These white-label solutions allow you to maintain your brand identity while easing the customer’s path to purchase and driving sales. The offerings will allow you to spotlight your unique value proposition, such as stocking products based on the local areas’ preferences and giving you complete control of your online pricing. These e-commerce platforms will tailor your messages to resonate with your loyal customers and reinforce the fact that you’re the steadfast neighbor.

It should be noted that there is plenty of innovation in this quadrant. Take “Scan & Go” (which is currently available from Self Point); Scan & Go allows your customers to use their own mobile devices in your store to make shopping more efficient, fast and even fun. The app guides consumers with maps and shopping lists through your physical store. Consumers scan their own items as they put them in the cart and thus skip the checkout line.

Customer experience extends beyond just the usability of an individual mobile application; it includes the quality of every order placed. Consumers have a very low threshold for errors in their online orders. The phrase “perfect order every time,” is the necessary motto of any grocer getting into the online space. To meet this challenge, Self Point has developed a mobile collection application for your employees. It is specifically designed to prevent human error by validating the accuracy of the barcode as well as the count and the weight of every item as it is taken off the shelf by the picker.

Top-Down Solutions: Unata, Mercatus and Orckestra

These solutions in the top left quadrant are robust, long-term initiatives that are well-suited to large retail chains. They require significant initial and ongoing investments, as well as resources from every division of a grocer’s leadership team. They boast a number of extremely elegant features. Unata, for example, has a “you may also like” personalization engine that is very elegant (using machine learning to personalize the entire shopping experience also is a top priority at Self Point). Mercatus was born from a deep grocery marketing expertise, and that is very much brought to life in their comprehensive offering that includes both online and off-line marketing capabilities.

Due to the complexities of implementing the solutions, deep involvement with grocers’ IT departments may be required. Unlike the agile solutions partners, they are not as nimble with innovations nor are they apt to customize the technology for a medium- or small-sized chain.

Top-down solutions certainly benefit some larger supermarket chains, providing enhanced targeting capabilities and other features. If you have the time and the money, all three of the companies in this quadrant are worth your consideration

Affiliate Marketplaces: Instacart, Rosie and Shipt

Super easy and fast, these companies will bring new orders to your store. They will handle the picking and fulfillment of each online order. They offer a turn-key solution; you don’t have to think or work a bit. There is just one small catch: you’re giving away all control of the customer experience, as well your customers. You are losing brand control and your entire relationship with the consumer. In some cases, you even have to agree to let these partners modify your prices. It’s likely that consumers will see higher costs from your stores on these online marketplaces.

In the end, the shopper’s relationship is with the affiliate marketers instead of your brand. Those shoppers can price-check and float among all the other grocers in your area who are on their platforms with just a tap on their phone. Don’t expect loyalty. In fact, you will not know who your loyal customers are since you won’t have insight into that data anymore.

It is also worth noting that Shipt recently was purchased by Target. Grocers who choose Shipt will most likely find themselves in an online marketplace where the consumer is always one tap away from checking to see if prices are lower at the nearest Target.

If you are strapped for time and money, one of the affiliate marketplaces can be a logical alternative and first step before graduating to a white label, agile solution. Think of it like an additional sales channel. It’s not your core business, but you can gain an online presence. And in this market, with Amazon-Whole Foods prepping to dominate the industry, you must be online in some capacity.

Speed matters in this hyper-competitive environment, which is the reason some grocers may choose to partner with an affiliate marketplace. A recent article by retail consultant Brittain Ladd, “The Trojan Horse: Instacart’s Covert Operation Against Grocery Retailers,” has an alternate point of view.

Ladd says, “I have been on the record since 2015 stating that any retailer that signs an agreement with Instacart is making a significant error in judgement and strategy. Why? Because once Instacart walks in through the front door of a grocery retailer they will capture every detail as to how that grocery retailer operates.”

While I agree with Ladd in principle, I also recognize some grocers out there simply don’t have the time or the money to do anything else.

Hybrid Solution

One approach that may make sense for some grocers is adopting a hybrid solution. Start with an affiliate marketplace while developing your own digital storefront on a parallel track. You can get the best of both worlds with Instacart serving its own customers through your store, while you offer delivery and/or curbside pickups to your customers at the same time. Let Instacart spend the money and time to bring their customers to you. Meanwhile, you can focus on retaining your existing loyal shoppers who crave the convenience of digital from their local neighborhood grocer as well as adjacent new customers who will give your store a try once they know you offer a multitude of convenient shopping options.

Legacy Solution: My Web Grocer

My Web Grocer (MWG) was among the first in supporting food retailers to transition to online storefronts. As a result, MWG has a significant share of the market and is truly in its own category. MWG has positioned itself as a good fit for large supermarket chains and gets a lot of credit for having survived when others did not (remember webvan?). MWG has invested a tremendous amount into making the platform friendly to advertisements from CPG manufacturers. The downside is too many advertisements from CPG companies—which consumers sometimes complain about. Although many grocers I know seem to be dissatisifed with their platform at this point, I wouldn’t count them out.

A few questions to ask yourself

In summary, I’d like to offer you a few questions to ask yourself as you evaluate each digital commerce partner:

- What happens to my brand?

- Is it a white label solution? Does this solution highlight my brand and my relationship with my customer?

- Will I be able to control the experience, my prices, my merchandising?

- Will my customers still know who they are shopping from?

- How do they handle onboarding?

- Do they have a white-glove process to set up all my products directly from my POS? Or am I going to have to maintain two sets of inventory and records—one for in-store and one for online?

- What about my local products with four-digit PLU codes; will they help me set those up?

- How do they handle weighables with embedded barcodes? Can their system read embedded barcodes?

- Who is going to manage photography? Will the solution provider offer this as part of a full-service implementation or will I have to hire a professional photographer or subscribe to some ancillary database of stock photos?

- Do they have experience as grocers and understand grocery logistics?

- Are they focused on the logistics?

- Can they help me figure out how to redesign my store to accommodate digital transformation?

- Will they bring someone personally into each of my locations to help determine where to handle fulfilment of online orders?

- Do they have a picking application that will make the collection process easy and error-proof?

- What is the focus of the company?

- Does the company have a grocery mindset? Or are they a Silicon Valley-style startup just looking to make a fast buck on an exit?

- Am I going to be a big account with these guys or just a small fry?

- Do they truly understand the challenges of the grocery business down to the team member who must pick and pack online orders?

- And lastly, can the folks who are presenting to you pass the “elevator test?” (If you were trapped in an elevator with them for an extended period of time, could they help you get out or would they make survival even harder?)

It’s not about likability. It’s about understanding your business and, most importantly, trust. Do you trust this team with the future of your business? If you can’t answer that with a strong yes, keep looking.

The world of online grocery shopping is changing at a remarkable pace, but there is a still time for grocers to get into the game and win. The advent of new technologies will not change the fundamentals of consumers’ needs. People want now what they have always wanted: easy access to quality food at a fair price. As the neighborhood grocer, you understand your local customers better than anyone else. Let the digital commerce partner who best matches your needs help with the technology. Since e-commerce will be ever-evolving, you need a trusted partner who will continuously innovate so you can focus on your core business. After that, everything else falls into place.

Self Point can provide success stories and a detailed demo; [email protected] or 888-300-9298.

Mike Haaf is CEO of Self Point. He has more than 20 years of experience in marketing, business strategy and leadership roles, serving in executive positions at Lucky Supermarkets, Food Lion, Office Depot, GE and more. As EVP and GM at Lucky Supermarkets, a Save Mart company, Haaf led the turnaround of the business, growing the topline and delivering profitability for the first time in 15 years. During his tenure as SVP of sales, marketing and business strategy at Food Lion, he led the turnaround and then growth of the business by fundamentally reorganizing around the customer, contributing to the more than six times growth in the market cap of the company. Haaf has an MBA from Columbia Business School and serves as an advisor, as well as a member of the board of directors of several technology startups.

Keep reading:

Conference Speaker: Trends Behind ‘Retailmaggedon’ Aren’t Going Anywhere

GrocerKey Finalizes $2.5M Investment Round Led By Woodman’s Markets

Mercatus Partners With Shipt To Bring Last-Mile Delivery To More Grocers

I’m not looking for the cheapest option and it seems this guy is trying to convince us to use his company because it’s the cheapest. Why else is the bottom line about cost. Also when we spoke to this company the setup fee was 5 times more then any of the others we looked at. How about an unbiased look at the industry rather than a sales piece dressed up as research.

I am the SVP of Client Engagement with MyWebGrocer, and Mike Haaf, a guy who I have personally known for over 20 years, never did the due diligence to separate fact from fiction, and this article is preditory at best in an attempt to get a start up, with no substantial US based clients , off the ground:

-MWG has been in this business for 16 years and was bound to go through version changes.

-Our new platform is nothing short of brilliant ….complete agility with our clients in a light, API enables architecture. Mike, after 20’years of friendship, maybe a call to learn where we are???

-There is no provider with a more advanced picking solution. Our President, Barry Clogan, comes from a career of running eCommerce for Tesco. He brought operational experts with him that provide not just best….but prestine in class operational picking solutions.

-We can make the cost of the eCommerce voyage self liquidating through our national ad media network.

-Our mobile app is fully integrated

-Wr just signed an agreement with dunnhumby to bring world class targeting to eCommerce

-We now have an agreement with Shipt to seamlessly integrate final mile from click to purchase

So Mike, please do your research the next time you with to use a fine media such as the Shelby Report to self serve small start up needs.

Rob, thanks for reaching out to me personally since I consider you a friend and colleague.

The article title says it all: A BIASED Grocer’s Guide or Why I Became CEO of Self Point.

I did my due diligence and have been impressed by the smart, dedicated team at Self Point – that’s the reason I joined! My objective in this is article is simply to provide additional information to grocers as they wade through potential solution partners.

All the best,

Thanks!

….and readers, sorry for my slight typos. This posting made me so emotional that my thumbs simply could not keep up with my brain.

Your analysis doesn’t include a important player: Ocado (from the UK). Currently trades on their own behalf (in a very mature grocery ecommerce market, with some websites running for more than 20 years, and grocery ecommerce running upwards of 15% of all grocery revenue). Also white labels for Morrisons, and is acquiring clients in Europe and Canada on a turnkey basis.

In you quadrant I would show Ocado as top left, with mature scalable systems for store pick and warehouse pick, website, order management, delivery vehicle routing, and, uniquely, mechanisation solutions for warehouse pick. Most likely to be able to minimise cost of operations at scale end to end, and with robust processes for the customer and the retailer in control.

I would also say that your analysis is not at all applicable or relevant to an ultra-mature market like the UK. None of the players mentioned is likely to be considered by existing UK grocers, the top 4 developed their own platforms years ago, some based on IBM WCS/Sterling and M-netics, some just Sterling, some completely bespoke. For reference, the top 4 is Tesco, Sainsbury, Asda Wal*Mart, Morrisons (with Ocado), with upmarket Waitrose also offering online (all pretty much UK wide), and pureplay Ocado (not countrywide). Sainsbury’s is bidding to buy out Asda Walmart (with Walmart getting a stake in Sainsbury’s in return).

Also in your analysis, you should mention a key item of history: Safeway Groceryworks. Originally a joint venture between UK leader Tesco (first to market, shortly after Webvan but before Peapod) and Safeway, but the JV dissolved in 2007 (when Tesco tried to open in Caifornia as Fresh & Easy). The Safeway offer I think still uses key systems inherited from Tesco for website merchandising, order management, vehicle assignment and store picking (together known internally in Tesco as BoB; Tesco itself is on a later rewrite of the systems based around an in house developed core called Martini–nothing to do with Blue Martini, just a silly name based on a the tagline in UK television advert for the vermouth.)

Miles, thanks for your comment and information about the UK market. This research is based on U.S. solutions providers. I agree that the UK companies have a head start!

Mike Thomas

You make a great point. We have many former Tesco employees at MyWebGrocer, including our President, Barry Clogan, who (as I pointed out in my last comment) ran eCommerce for Tesco at one point in his career. We also employ operations specialists who were former Tesco.

The reality is that the US market is still in its infancy, but by 2025 over 2 Billion brick and mortar shopping trips will be lost to eCommerce, and that is when things get very interesting, as within the high density markets the physical in-store pickers will begin to annoy the actual brick and mortar shoppers!

We have very advanced analysis/algorithms to project when certain milestones will be reached for any given retailer in any given market. This helps them to prepare. I guess the point we are both making is that successful eCommerce is not just about price and working with inexperienced start-ups to secure a fast and cheap solution….it also has to be good!

As this entire business matures it will be thought leadership on micro-strategy based architecture, commercialization, operational excellence and the leveraging of data that will win the day. Please see my articles on LinkedIn!

Rob