The race to master omnichannel retail within the grocery/consumer packaged goods space is on, according to research conducted by Nielsen.

With Walmart’s successful push toward online migration, the rapid rise of grocery delivery players like Instacart and Amazon’s foray into physical stores, it’s really anyone’s game to win.

While it’s premature to predict how Amazon will do with its brick-and-mortar grocery store rollout, it is in unfamiliar territory as an underdog.

But when examining its roots, can Amazon still fall back on its supremacy over the e-commerce landscape?

New Nielsen e-commerce data, powered by Rakuten Intelligence, shows that Amazon’s dominance in digital retail, specifically for CPG products, is slipping. In fact, over the past two years, established brick and mortar stores have significantly tightened their reigns, closing the competitive gap.

While it’s no secret that traditional brick and mortar retailers have made online selling a priority, Nielsen data shows that they have turned strategy into reality, with incredible growth. In fact, key retail players like Walmart, Kroger and Target have grown their online customer base–all by at least 90% more than Amazon, over the past two years.

Amazon still has significantly greater buyer reach – 10 times more – than any of the other merchants, so there’s not as much room to grow its buyer base. But that’s not the only reason for the rapid success of its competitors.

These merchants have succeeded in part because they’ve embraced the click-and-carry model of purchasing an item online and picking it up in a physical store. In fact, we estimate share of click-and-carry grew from 4% to 11% of all CPG e-commerce sales in just two years. This model is giving consumers the confidence to expand beyond health and beauty toward products like grocery and gourmet food, which has a compound annual growth rate (CAGR) of nearly 50% over the past three years, just behind pet supplies.

Opportunities abound in online CPG

At a high level, online penetration of CPG keeps growing. CPG online sales have increased 30% year over year, and 60% of shoppers have browsed and ordered CPG online. And instead of being one-time purchasers, more than one-quarter (28%) of shoppers have purchased CPG online a few times per month.

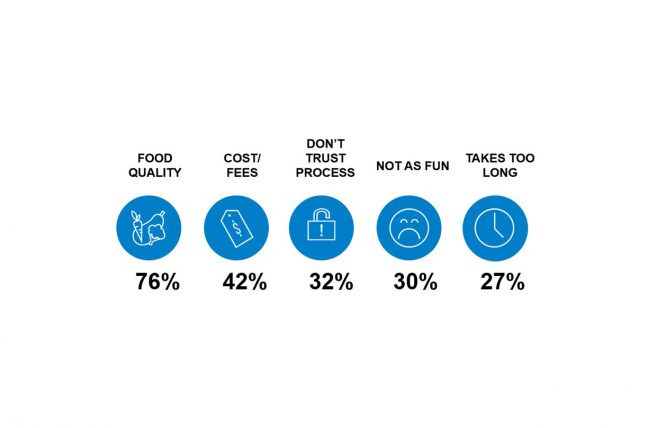

Yet despite the increased willingness of consumers to shop online, challenges remain. 29 million people began shopping for CPG products online in the past two years, yet only two-thirds of all e-commerce shoppers buy CPG products through the internet. When asked about the barriers that deter them from buying CPG items online, shoppers said the following:

Connecting with unreached CPG e-commerce consumers represents a massive opportunity. Amazon still sits on the e-commerce throne, but the competitors are circling as all battle for their piece of the omnichannel pie.

The insights in this article were derived from Nielsen Total US E-commerce measurement powered by Rakuten Intelligence, 52 weeks ending Jan. 31, 2019, and the Nielsen Digital Shopping Report, 2018.

1 Comment