Last updated on May 21st, 2018 at 10:22 am

Walmart has released its first-quarter earnings report, and its numbers are up.

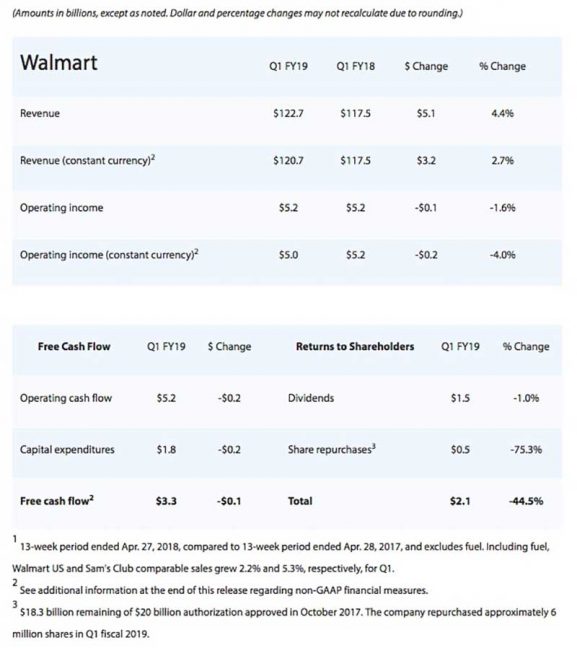

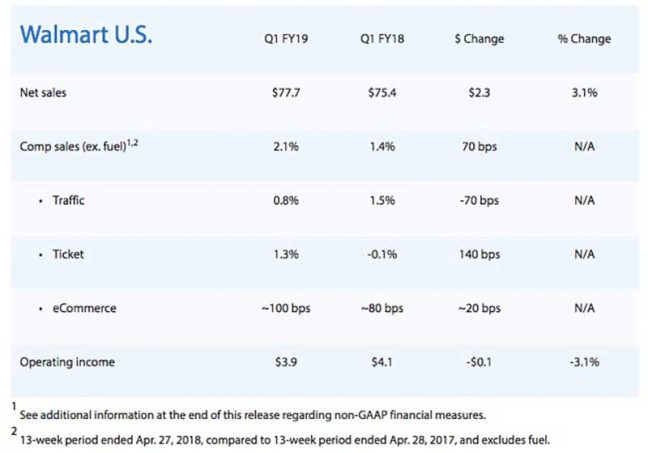

Total revenue for the retail giant was $122.7 billion, an increase of $5.1 billion, or 4.4 percent. Excluding currency, total revenue was $120.7 billion, an increase of $3.2 billion, or 2.7 percent. Walmart U.S. comp sales increased 2.1 percent, and comp traffic increased 0.8 percent. E-commerce sales grew by 33 percent.

“We delivered a solid first quarter, and we’re encouraged by the continued momentum across the business,” said President and CEO Doug McMillon. “We’re transforming to better serve customers. We are changing from within to be faster and more digital, while shaping our portfolio of businesses for the future. Our strong cash flow and balance sheet provide flexibility to do so. I want to thank our associates and our leadership team for the choices they’re making, their strong sense of urgency and the actions they’re taking. Our people make the difference, and I’m proud to work with them.”

Among other highlight of the report are:

- Walmart’s GAAP EPS declined 28 percent in the first quarter, and adjusted EPS increased 14 percent.

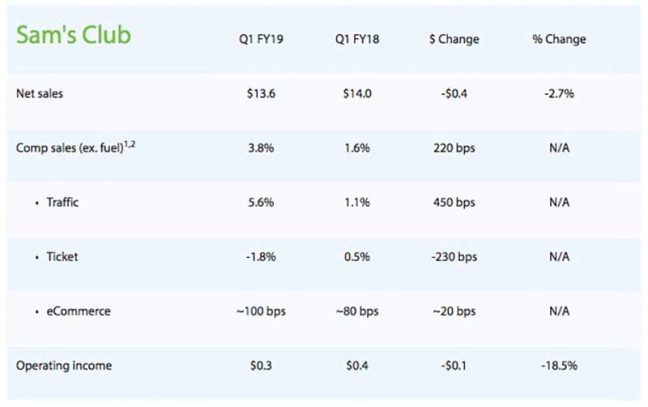

- Sam’s Club comp sales increased 3.8 percent led by comp traffic growth of 5.6 percent. Tobacco sales negatively impacted comp sales by approximately 140 basis points.

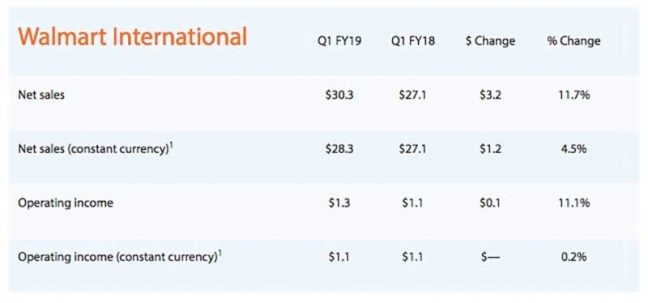

- Net sales at Walmart International were $30.3 billion, an increase of 11.7 percent. Excluding currency, net sales were $28.3 billion, an increase of 4.5 percent. Eight of eleven markets posted positive comp sales, including our four largest markets.

- The company generated $5.2 billion in operating cash flow.

- Adjusted EPS excludes the impact of two items. The first item is an unrealized loss of $0.47 on the company’s equity investment in JD.com due to a change in accounting principles. The second item benefited EPS by $0.05 due to an adjustment in the provisional amount recorded in Q4 fiscal 2018 related to tax reform.

Key results

Portfolio repositioning

“Thoughtful and deliberate consideration of (Walmart’s) portfolio of businesses is a key enabler of its strategic framework,” the company said in a press release. Recently announced transactions include the following:

Investment in Flipkart Group

- On May 9, Walmart signed definitive agreements to become the largest shareholder in Flipkart, an Indian e-commerce company. The investment will help accelerate Flipkart’s customer-focused mission to transform commerce in India, the company says. Subject to regulatory approval in India, Walmart will pay approximately $16 billion for an initial stake of approximately 77 percent.

- Walmart’s investment includes $2 billion of new equity funding, which will help Flipkart accelerate growth in the future. The companies also are in discussions with additional potential investors.

Combination of Sainsbury and Asda, Walmart’s U.K. subsidiary

- On April 30, Walmart and Sainsbury’s announced the proposed combination of these two businesses. Under the terms of the combination, Walmart would receive cash and approximately 42 percent of the combined business.

Sale of Banking Operations

- Walmart recently reached agreements to divest banking operations in Walmart Canada and Walmart Chile. The company says the proposed actions are consistent with the company’s focus on core retail capabilities.

Guidance

Walmart’s investment in Flipkart is expected to negatively impact fiscal year 2019 EPS by approximately $0.25 to $0.30 if the transaction closes at the end of the second quarter. As in past years, Walmart will update certain full year guidance with the second quarter release.

Unrealized gains and losses

Since taking an initial stake in JD.com, the market value of Walmart’s investment had increased $3.7 billion as of January 31, 2018. In prior periods, the company was not required to include unrealized gains/losses within net income. Beginning in fiscal year 2019, due to a change in U.S. accounting principles, Walmart is now required to include unrealized gains/losses of certain equity investments within net income. This quarter, the company recorded an unrealized loss of $1.8 billion due to a decline in the JD.com stock price during the quarter.

Segment results

This quarter, the company revised its corporate overhead allocations to the operating segments. Accordingly, previous segment operating income was recast to be comparable to the current period’s presentation.

Keep reading:

Walmart Releases 2018 Annual Report, Changes Coming To The Board