Last updated on April 29th, 2016 at 11:19 am

IRI has revealed last year’s most successful consumer packaged goods launches in its 2015 New Product Pacesetters report, an industry-recognized benchmark analysis of exceptional first-year CPG sales success for newly launched products. Thousands of new brands hit retail shelves last year, with 54 percent of all new product launches hailing from the food and beverage aisles, while the remaining 46 percent came from the non-food realm. The top-selling 200 new brands captured cumulative year-one sales of more than $6.5 billion across IRI’s multi-outlet geography.

“The key to launching a successful new product today is not only understanding your core and target shoppers but also how these shoppers view the CPG marketplace,” said Susan Viamari, VP of thought leadership at IRI. “Their viewpoint is very different from manufacturers and retailers. Consumers think about satisfying needs in terms of eating occasions, drinking occasions and product usage occasions. CPGs need to recognize which CPG categories compete for each occasion. It varies by mind-set, daypart, channel and shopper, so the days of one-size-fits-all strategies are gone forever.”

Added Larry Levin, EVP of business development at IRI, “The good news is that technology and analytic know-how play a huge role in creating an understanding about market trends and consumers’ needs and wants, and how those factors impact the way consumers make purchase decisions. CPG marketers must harness that knowledge to understand sources of volume and incrementality for each of their brands across usage occasions—in other words, know where your sales are coming from. Ultimately, marketers are looking to get the full pool of potential consumers to buy more, rather than just shifting dollars from one brand within the portfolio to another.”

Food and beverage launches capture $19.6 million in median year-one sales

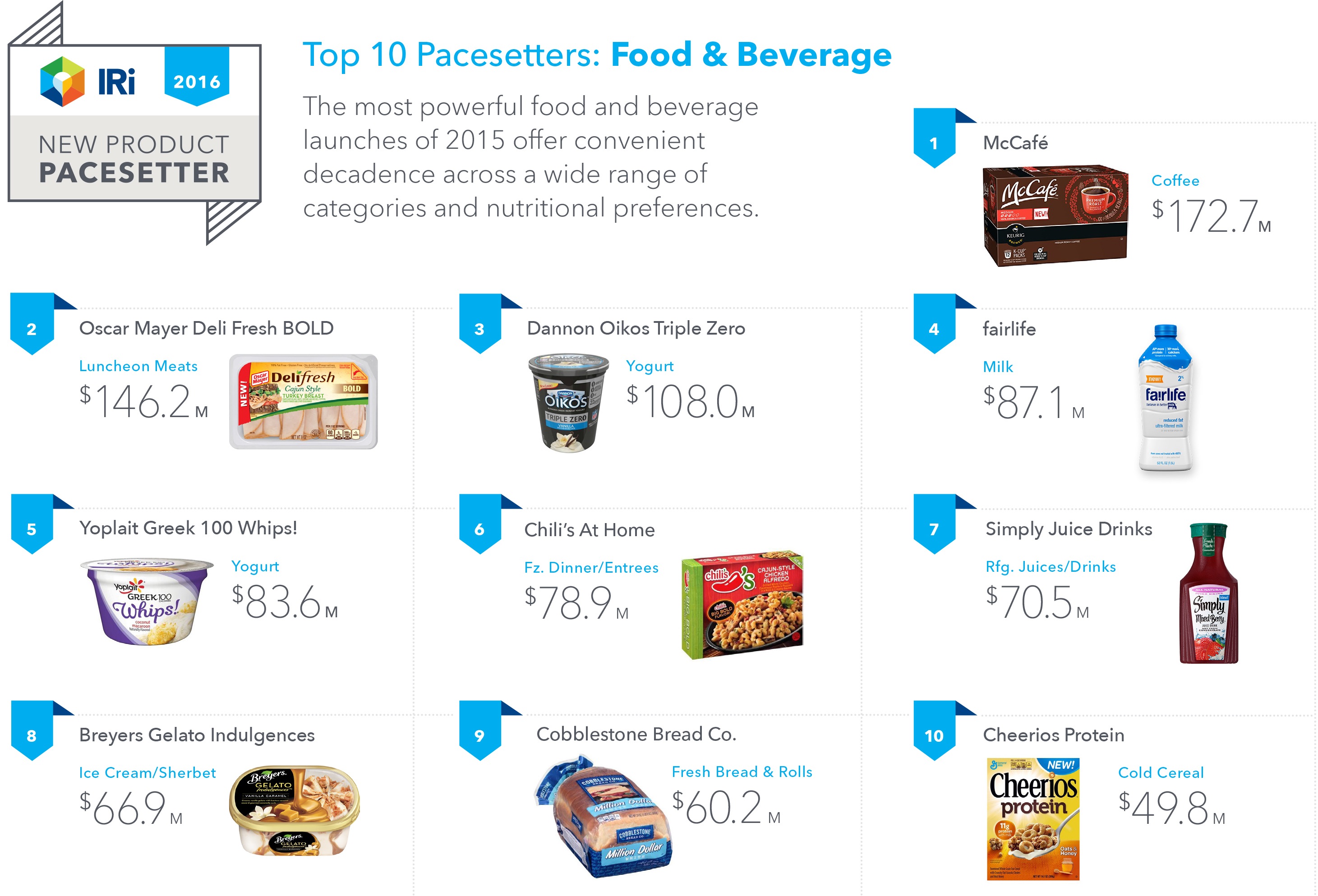

For the top 100 food and beverage champions, median year-one dollar sales were $19.6 million, down from $22.9 million in 2014. These top-performing products provide much-needed indulgence and offer an experience that brings excitement into the kitchen.

|

2015 New Product Pacesetters: Top 10 Food and Beverage Brands |

||

|

($ Millions) |

||

|

(Total Year-One Dollar Sales, Multi-Outlet) |

||

|

1. McCafé |

$172.7 |

|

|

2. Oscar Mayer Deli Fresh BOLD |

$146.2 |

|

|

3. Dannon Oikos Triple Zero |

$108.0 |

|

|

4. fairlife |

$87.1 |

|

|

5. Yoplait Greek 100 Whips! |

$83.6 |

|

|

6. Chili’s At Home |

$78.9 |

|

|

7. Simply Juice Drinks |

$70.5 |

|

|

8. Breyers Gelato Indulgences |

$66.9 |

|

|

9. Cobblestone Bread Co. |

$60.2 |

|

|

10. Cheerios Protein |

$49.8 |

|

Exciting and high-end attributes are found in the top-ranking products and are in line with what consumers are saying they want from new food products. According to IRI’s 2016 New Product Survey, 29 percent want to indulge without paying restaurant prices; 24 percent want to add excitement to their daily diet; and 21 percent seek options that are truly new and different.

Consumers definitely want flavor excitement to spice up their daily diets, as well as healthier-for-you solutions. For instance, fairlife milk uses a new, patented filtration process that concentrates some of milk’s natural nutrients, while filtering out lactose and reducing sugars. And loads of flavor is found in crossover brands from restaurants and other realms, such as Chili’s At Home frozen dinners and McCafé coffee.

Non-food champions secure $26.5 million in median year-one sales

When it comes to non-food products, 20 percent of consumers actively seek new home care products that are good for the environment, and 17 percent look for beauty products that offer anti-aging benefits, according to survey results. This is an important lesson in new product innovation: Everyone has different needs, wants and priorities. And today’s shoppers want CPG solutions that recognize this fact. This is abundantly clear across the wide range of 100 top-performing non-food brands, which had median year-one dollar sales of $26.5 million. Top sellers include Tide Simply Clean and Fresh laundry detergent, Purina Beyond pet food and Sally Hansen Miracle Gel nail cosmetics.

|

2015 New Product Pacesetters: Top 10 Non-Food Brands |

||

|

($ Millions) |

||

|

(Total Year-One Dollar Sales, Multi-Outlet) |

||

|

1. Nexium 24HR |

$270.6 |

|

|

2. Air Wick Life Scents |

$172.5 |

|

|

3. Tide Simply Clean and Fresh |

$167.5 |

|

|

4. Always Discreet |

$133.0 |

|

|

5. Amopé Pedi Perfect |

$128.1 |

|

|

6. Purina Beyond |

$108.0 |

|

|

7. Sally Hansen Miracle Gel |

$98.0 |

|

|

8. Gillette Fusion ProGlide with FlexBall Technology |

$86.6 |

|

|

9. Gillette Venus Swirl |

$74.1 |

|

|

10. Glad OdorShield with Febreze Freshness & Gain |

$70.4 |

|

CPG innovators are helping consumers express their individuality by offering a variety of olfactory experiences. The largest olfactory launch of 2015 was Air Wick Life Scents, which fills the home with continuous, fresh fragrance for up to 60 days and also allows consumers to select their desired fragrance level. Unique and exciting scent experiences also can be found in the kitchen with Glad OdorShield with Febreze Freshness & Gain.

Top launches capture median $18.6 million in first-year sales in convenience stores

In the convenience store arena, median year-one sales across the top 10 IRI New Product Pacesetters were an astounding $18.6 million, demonstrating the power behind consumers’ ongoing quests for uniquely indulgent experiences.

|

2015 New Product Pacesetters: Top 10 Convenience Store Brands |

||

|

($ Millions) |

||

|

(Total Year-One Dollar Sales, Convenience Store Channel) |

||

|

1. VUSE |

$221.1 |

|

|

2. Monster Energy Ultra Sunrise |

$82.7 |

|

|

3. MarkTen |

$69.3 |

|

|

4. REDD’S Wicked Ales |

$43.3 |

|

|

5. RUFFLES Deep Ridged |

$26.5 |

|

|

6. Jack Link’s Small Batch |

$18.9 |

|

|

7. Juicy Fruit Starburst |

$18.4 |

|

|

8. Monster Energy Unleaded |

$17.1 |

|

|

9. Wrigley’s 5 Ascent |

$14.6 |

|

|

10. Pillsbury Soft Baked Mini Cookies |

$10.0 |

|

“To be successful, marketers must have a clear, comprehensive and consistent understanding of their competitive set, despite rapidly changing market conditions and fickle consumer attitudes and behaviors,” said Viamari. “These insights will help CPGs address white space innovation opportunities that meet the needs of high-potential consumer segments. This knowledge will also support development of highly accurate sales forecasting and brand development programs that will minimize launch failure and maximize market potential.”

1 Comment