Last updated on June 13th, 2024 at 12:03 pm

The Selig Center’s estimates and projections of buying power for 1990-2015 show that minorities—African Americans, Asians, Native Americans and Hispanics—wield formidable economic clout. The numbers are impressive. In 2010, the Hispanic market ($1 trillion) is larger than the entire economies (2009 GDP measured in U.S. dollars as reported in the CIA World Factbook) of all but 14 countries in the world—smaller than the GDP of Canada and larger than the GDP of Indonesia.

The buying power data presented here and differences in spending by race and/or ethnicity suggest that as the U.S. consumer market becomes more diverse, advertising, products and media must be tailored to each market segment. With this in mind, entrepreneurs, established businesses, marketing specialists, economic development organizations and chambers of commerce now seek estimates of the buying power of the nation’s major racial and ethnic minority groups. Going beyond the intuitive approaches often used, the Selig Center’s estimates provide a timely, cost-efficient and quantitative way to assess the size and vitality of the national and state racial and ethnic markets. This study provides a comprehensive statistical overview of the buying power of African Americans, Asians, Native Americans and Hispanics for the U.S. and all the states. Data are provided for 1990-2015. Majority—or white—buying power also is reported. [Researchers should note that multiracial buying power is estimated only as a residual, and therefore the estimates are not discussed and should be used very cautiously.]

Simply defined, buying power is the total personal income of residents that is available, after taxes, for spending on virtually everything that they buy, but it does not include dollars that are borrowed or that were saved in previous years. It is not a measure of wealth, and it does not include what tourists spend during their visits. Unfortunately, there are no geographically precise surveys of annual expenditures and income of all the nation’s major racial and ethnic groups. Even estimates of expenditures by race or ethnicity are difficult to find, especially for individual states.

The Selig Center addresses this problem by providing estimates of African American, Native American, Asian, White, Hispanic and non-Hispanic buying power from 1990-2010 for the nation, the 50 states and the District of Columbia. Also, five-year projections (2011-15) are provided for all groups. (Due to funding limitations, the Selig Center no longer provides estimates for Georgia’s and Florida’s metropolitan areas and counties.) These current dollar (unadjusted for inflation) estimates and projections indicate the growing economic power of various racial or ethnic groups; measure the relative vitality of geographic markets; help to judge business opportunities for start-ups or expansions; gauge a business’s annual sales growth against potential market increases; indicate the market potential of new and existing products; and guide targeted advertising campaigns.

The estimates for 1990-2010 supersede those previously published by the Selig Center. The revised data for those years, as well as the preliminary projections for 2011-15, should be considered only as the first step toward a more comprehensive analysis of the market. Anyone considering the investment of substantial capital in a new enterprise, a new product line or a new advertising campaign will need extensive feasibility analysis to determine market opportunities more precisely.

The Multicultural Economy book, reports buying power and population estimates for 1990, 2000, 2010 and 2015 only, but the complete time series data for 1990-2015 are available on CD. For more information regarding this information, please see the Selig Center’s website at www.selig.uga.edu.

Total Buying Power Statistics

Total Buying Power Statistics

The Selig Center projects that the nation’s total buying power will rise from $4.2 trillion in 1990 to $7.3 trillion in 2000 to $11.1 trillion in 2010 and to $14.1 trillion in 2015. The percentage increase for 1990-2015 is 233 percent. From 1990-2010, total buying power will rise by 162 percent, which far outstrips cumulative inflation. For example, the U..S. Consumer Price Index for All Urban Consumers (CPI-U) will increase by approximately 68 percent during the same period. Total buying power will expand by 52 percent from 2000 through 2010, and by 27 percent from 2010 through 2015. By comparison, from 2000 to 2010, the U.S. CPI-U will increase by about 26 percent.

Diverse forces support this substantial growth. The 26-year span encompasses a mild recession in 1990-91, the longest economic expansion in the nation’s history from 1991-2000, another mild recession in 2001, a modest expansion from 2002-2007, and a severe recession that began late in 2007 and continued through mid-2009. As this is written, U.S economic conditions can accurately be described as recessionary, and the assumption underlying the baseline forecast calls for moderate growth in 2010 that persists through 2015.

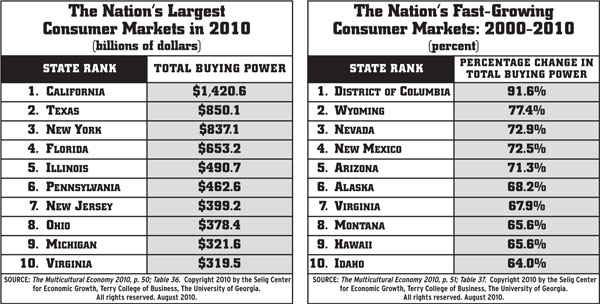

Ranked by percentage change in total buying power between 2000 and 2010, the top 10 states are District of Columbia (92 percent), Wyoming (77 percent) Nevada (73 percent), New Mexico (73 percent), Arizona (71 percent), Alaska (68 percent), Virginia (68 percent), Montana (66 percent), Hawaii (66 percent) and Idaho (64 percent). From 2000 through 2010, the five slowest growing states are Michigan (28 percent), Ohio (35 percent), Indiana (40 percent), Illinois (42 percent) and Wisconsin (43 percent).

That the state estimates show differing outcomes is not surprising, given the differences in industrial bases, the importance of exports, dependence on defense spending, real estate markets, labor markets, immigration rates, domestic migration rates, and natural resources. As always, states with low costs of doing business, favorable regulatory environments, updated transportation and telecommunications infrastructure, educated workforces and an abundance of natural resources will continue to attract domestic and international businesses.

Buying Power Statistics by Race

In 2010, the combined buying power of African Americans, Asians and Native Americans will be $1.6 trillion—72 percent higher than its 2000 level of $915 billion—which amounts to a gain of $654 billion. In 2010, African Americans will account for 61 percent of combined spending, or $957 billion. Between 2000 and 2010, the percentage gains in buying power vary considerably by race, from a gain of 98 percent for Asians to 69 percent for American Indians to 60 percent for blacks. All of these target markets will grow much faster than the white market, where buying power will increase by 49 percent.

The combined buying power of these three racial groups will account for 14.1 percent of the nation’s total buying power in 2010, up from 12.5 percent in 2000 and from 10.6 percent in 1990. The 1990 to 2010 gain in combined market share of 3.5 percent amounts to an additional $385 billion in buying power in 2010. The market share claimed by a targeted group of consumers is important because the higher their market share, the lower the average cost of reaching a potential buyer in the group. The combined buying power of these racial groups will rise to $2.1 trillion in 2015, accounting for 15 percent of the nation’s total buying power.

[gn_button link=”https://www.theshelbyreport.com//2011/10/14/african-american-buying-power/” color=”#00cc33″ size=”2″ style=”2″ dark=”0″ square=”0″ target=”self”]African-American Buying Power[/gn_button] [gn_button link=”https://www.theshelbyreport.com//2011/10/28/native-american-buying-power/” color=”#00cc33″ size=”2″ style=”2″ dark=”0″ square=”0″ target=”self”]Native American Buying Power[/gn_button] [gn_button link=”https://www.theshelbyreport.com//2011/07/01/hispanic-buying-power/” color=”#00cc33″ size=”2″ style=”2″ dark=”0″ square=”0″ target=”self”]Hispanic Buying Power[/gn_button] [gn_button link=”https://www.theshelbyreport.com//2011/10/28/asian-buying-power/” color=”#00cc33″ size=”2″ style=”2″ dark=”0″ square=”0″ target=”self”]Asian Buying Power[/gn_button]Methodology

Because there are no direct measures of the buying power of African Americans, Native Americans, Asians, Whites, and Hispanics, these estimates were calculated using national and regional economic models, univariate forecasting techniques, and data from various U.S. government sources. The model developed by the Selig Center integrates statistical methods used in regional economics with those of market research. In general, the estimation process has two parts: estimating disposable personal income and allocating that estimate by race or ethnicity based on both population estimates and variances in per capita income.

The Selig Center’s estimates of disposable personal income (the total buying power of all groups, regardless of race or ethnicity) are reported in Table 5. Total buying power for 1990-2009 equals disposable personal income as reported in the National Income and Product Accounts tables by the U.S. Department of Commerce, Bureau of Economic Analysis, Regional Economic Information System in March 2010. Based on the data provided by the Commerce Department, the Selig Center prepared projections of total buying power for 2010-2015.

Defined as the share of total personal income that is available for spending on personal consumption, personal interest payments, and savings, disposable personal income measures the total buying power held by residents of an area. In 2009, 90.6 percent of disposable personal income was used to purchase goods and services (personal consumption expenditures); the remaining 9.4 percent represents personal savings, non-mortgage interest paid by persons, or personal transfer payments to either government or to persons living abroad.

Because the Selig Center defines buying power as disposable personal income, the state-by-state estimates of the total buying power of all consumers for 1990-2009 are identical to the estimates of disposable personal income issued by the U.S. Bureau of Economic Analysis (BEA) in 2009. Based on trends in the historical data, the Selig Center prepared independent estimates of total buying power (disposable personal income) for 2010-2015.

The Selig Center’s estimates are consistent with the concepts and definitions used in the National Income and Product Accounts (NIPA). Readers should note that buying power is not the equivalent of aggregate money income as defined by the Census Bureau. Because the Selig Center’s estimates are based on disposable personal income data obtained from the BEA, rather than money income values issued by the Census Bureau, the result is significantly higher estimates of buying power. There are several reasons for this lack of correspondence. First, the income definition used by the BEA is not the same as the definition used by the Census Bureau. Second, Census income data are gathered through a nationwide survey sample of households, and respondents tend to underreport their income, which accounts for much of the discrepancy. Finally, the population universe for the Census money income estimates differs from the universe used by the BEA. It should also be emphasized that the Selig Center’s estimates are not equivalent to aggregate consumer expenditures as reported in the Consumer Expenditure Survey that is conducted each year by the U.S. Bureau of Labor Statistics.

The Selig Center’s estimates of total buying power were allocated to each racial group and Hispanics based on population estimates and variances in per capita personal income by race or ethnicity. For 1990-1999, the Selig Center used the U.S. Census Bureau’s time series of intercensal population estimates that were last revised on August 5, 2004. The Census Bureau indicates that these estimates were developed to take into account differences between the postcensal time series population estimates for the 1990s and Census 2000 results. For 2000-2009, the Selig Center relied upon the population distributions provided by the Census Bureau’s Annual Estimates of the Resident Population of the United States: April 1 to July 1, 2009 that were released in June 2010. Because there are differences between these two data series, there is a series break between 1999 and 2000, which limits the comparability of the race-based estimates for 1990-1999 to those for 2000-2015. The main difference is that the multiracial category first appears in 2000. There is no series break for Hispanics, however. Based on trends in the historical data, the Selig Center prepared independent population projections for 2010-2015.

On August 14, 2008, the Census Bureau released Population by Sex, Race, and Hispanic Origin for the United States: 2010 to 2050. The Selig Center’s population estimates for 2010 through 2015 were not constrained to match the interim projections, though they were taken into consideration when we produced our independent projections.

The Census Bureau also has modified the definitions of the racial categories, by assigning persons who selected “some other race” to a specified race (e.g., White, Black or African American, American Indian and Alaska Native, Asian, Native Hawaiian and other Pacific Islander). This included persons who selected “some other race” in combination with a specified race. This was done to reconcile the Census 2000 race categories with those race categories that appear in the data from administrative records, which are used to produce the Census Bureau’s population estimates and projections. Approximately 18.5 million people identified “some other race” as part of, or as their only, race response.

For 1990-2015, a relative income adjustment factor was estimated for each group for each geographic area to compensate for the variation in per capita personal income (and by extension, in per capita disposable personal income) that is accounted for by race or ethnicity. These factors were calculated on an annual basis using Summary File 3 (SF 3) data regarding income by race and Hispanic origin from Census 2000 and per capita money income data by race for local areas that were gathered during the 1990 Census of Population and Housing. Also, the Selig Center relied on data obtained from the Census Bureau’s Current Population Survey and the American Community Survey.

The 2008 expenditures data by item for African Americans, Hispanics, Asians, and the comparison groups were obtained directly from the Consumer Expenditure Survey that was released by the Bureau of Labor Statistics on October 6, 2009. The amounts are direct out-of-pocket expenditures, and do not include reimbursements, such as for medical care or car repairs covered by insurance.

The Multicultural Economy 2010, Copyright 2010 by the Selig Center for Economic Growth, Terry College of Business, The University of Georgia. All rights reserved. August 2010. For more information on the Selig Center, visit their website at www.terry.uga.edu/selig.