Last updated on June 14th, 2024 at 10:26 am

Acosta Sales & Marketing has released the 11th edition of “The Why? Behind the Buy” report, which analyzes how Americans grocery shop and what drives consumers’ purchase decisions. Acosta’s latest research outlines shifts in the consumer decision-making process to help CPG companies and retailers hone their sales and marketing strategies.

“Grocery shopping has become a complex, consumer-centric matrix of options as Americans have more choices today than ever before,” said Colin Stewart, SVP at Acosta. “As consumers report saving an average of $67 per month due to lower gas prices, and directing some of those savings to food and groceries, there are even more decisions to make on what, where and how to buy. By better understanding current shopper behaviors and purchase drivers, brands and retailers can successfully convert these extra dollars into incremental sales.”

The Why? Behind the Buy reveals:

Lower gas prices enable consumers to spend elsewhere. Most shoppers indicate they will use gas savings for food/groceries, paying bills and going out more.

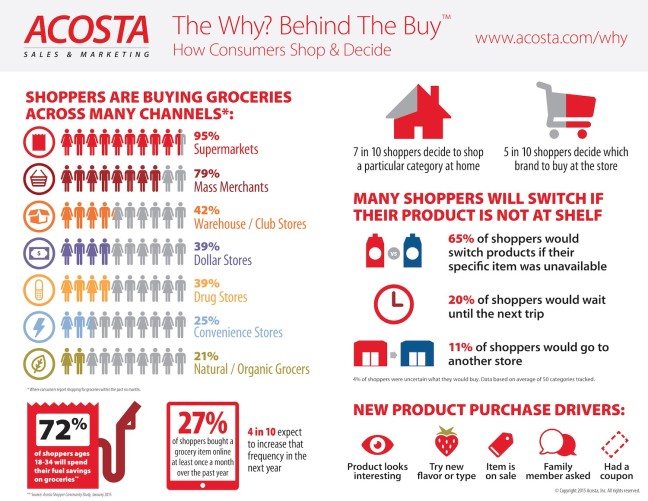

• Specifically, 72 percent of shoppers age 18-34 indicate they will be spending their fuel savings on groceries.

Shoppers don’t mind store surfing to meet their needs. The average shopper reported visiting about seven different store locations to buy groceries in the past six months. While shoppers are still buying groceries most often in a regular supermarket, the generational tide is turning with Gen X and Millennial shoppers.

• Ninety-five percent of U.S. shoppers report buying household groceries at regular supermarkets in the past six months; followed by shopping at mass merchants (79 percent); warehouse/club stores (42 percent); dollar and drug stores (39 percent); convenience stores (25 percent); natural/organic grocers (21 percent).

• Millennial and Gen X shoppers show slightly greater interest in drug stores, convenience stores and natural/organic grocers than total U.S. shoppers.

• Twenty-seven percent of shoppers reported purchasing a grocery item online at least once a month, over the past year, up from 23 percent reported in the 10th edition study. Four in 10 of those currently shopping online said that they expect to increase their order frequency in the next year.

Shopper decisions vary based on purchase category, brands and household influencers.

• While about seven in 10 shoppers make the decision to shop a particular category at home, 55 percent of shoppers typically decide what brand to buy while in the store.

• Shoppers feel that name brands are more important in some categories than in others.

• When it comes to product loyalty, 65 percent of shoppers will switch products if their specific item was unavailable; 20 percent will wait until the next trip; 11 percent will go to another store; and 4 percent are not sure what they would do (data based on average of 50 categories tracked).

• Although marketing tactics definitely impact purchase decisions, the success of approaches varies by category.

• Not surprisingly, female shoppers and shoppers with children in their household are spending the most time in the grocery store.

• New product purchase drivers vary by category, from finding a new product interesting, to being interested in a new flavor/type, or finding the item on sale.

The Why? Behind The Buy report was produced with research using a nationally representative random sample of U.S. shoppers via Acosta’s proprietary ShopperF1rst online survey in fall 2014.

Acosta is a leading full-service sales and marketing agency in the consumer packaged goods industry.