Last updated on June 14th, 2024 at 09:32 am

U.S. consumers are always looking to make the most of their hard-earned dollars, and with an array of choices on where to shop—from grocery stores to supercenters to warehouse clubs—they have no shortage of retailers from which to choose. So how are different retail channels keeping pace with today’s shopper and navigating today’s complex shopping landscape?

Consumers flocked to more than 6,100 new retail stores that opened across the U.S. between December 2013 and December 2015. While grocery stores and supercenters still drive the bulk of consumer packaged goods sales, two different channels are leading in store expansion. Together, dollar stores and convenience stores represented more than 87 percent of the total new store openings. And while c-stores had the highest total number of store openings (2,913), dollar stores are actually growing at the fastest rate (9 percent).

Why the surge in dollar stores? According to Nielsen’s latest global retail report, 68 percent of North Americans say they enjoy taking the time to find bargains. But it’s not just about price. While 55 percent of North Americans say low overall prices are highly influential in their decision to shop at a particular retailer, 56 percent say finding good value for their money is highly influential. Consumers are constantly on the hunt for personalized products that meet their needs, and dollar store retailers are responding to consumers’ value-driven desires at the highest rate.

How storefronts are navigating a polarized retail landscape

Some retailers have taken value into their own hands by launching private-label items (or store brands). A recent Nielsen survey on private labels showed that 70 percent of total U.S. households agree that store brands are a good alternative to name-brand products. Value stores in particular have seen private-label dollar share growth in the latest 52 weeks ending July 2, 2016, to 16.3 percent, up from 15.3 percent four years prior.

But value doesn’t end with lower cost products, and recent consumer trends can help retailers tap into what today’s shoppers value most. Consumers today are upping their focus on healthier living—in fact, 63 percent of Americans say they’re making conscious decisions to eat healthier food. For retailers, this means not only examining what’s on the shelves, but thinking through how to market their store as the ideal choice that fits the lifestyle and needs of the health-conscious consumer.

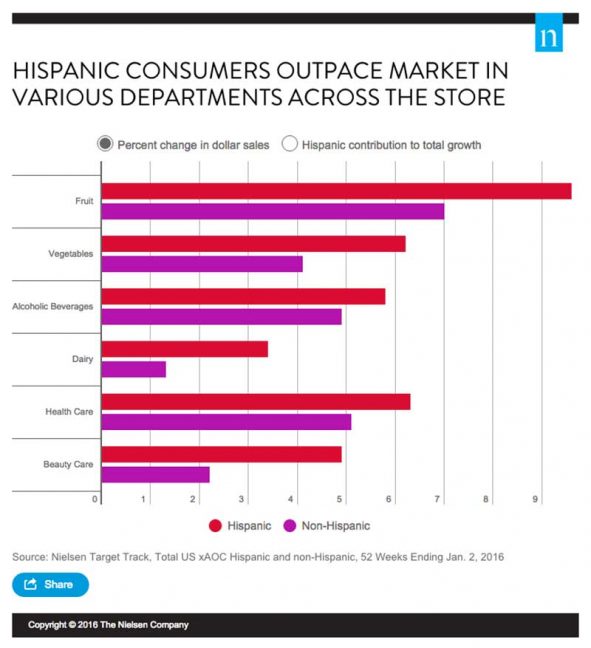

Diving deeper, consumer trends can vary among different segments of the population. And when it comes to retail, the multicultural makeup of America’s population is not to be ignored. By 2050, the number of Hispanics today is set to double. Hispanics tend to spend more on food in general (and 61 percent of Hispanic Millennials shop at Hispanic supermarkets). For example, Nielsen Target Track data revealed that the category growth for Hispanics outperform non-Hispanics across most departments in the store, particularly in fruits, vegetables and healthcare categories.

Diving deeper, consumer trends can vary among different segments of the population. And when it comes to retail, the multicultural makeup of America’s population is not to be ignored. By 2050, the number of Hispanics today is set to double. Hispanics tend to spend more on food in general (and 61 percent of Hispanic Millennials shop at Hispanic supermarkets). For example, Nielsen Target Track data revealed that the category growth for Hispanics outperform non-Hispanics across most departments in the store, particularly in fruits, vegetables and healthcare categories.

The convergence of these factors—value, health and wellness and growth of the Hispanic consumer—have created a polarized retail landscape. On one end of the spectrum, discount retailers are expected to rise, as value is driving consumers to search for the biggest bang for their buck. On the other end, retailers with premium products that cater to specific needs their specific needs will continue to attract and retain those consumers.

More than ever, retail is a highly local game, and retailers of all sizes need to gain deeper understanding of their markets to remain relevant to their customers. Retailers left in the middle of the totem pole will be left pinching for what’s left of any consumer attention that has not already been swept up, according to Nielsen.